What We're Doing

We are looking to buy and manage a business for long-term ownership. We look for profitable businesses that serve their communities and with outstanding reputations. Often times, the best sellers for us are retiring owners or families looking to transition their creation to the next phase of growth.

For hundreds of years a white dove has been the symbol of a new beginning, one filled with peace and prosperity. Similarly, we view the acquisition as an opportunity for a new beginning. Through preserving the legacy that made your business great and investing in people, technology, and operations, we hope to continue your business' growth for decades to come and take it to the next level.

What We Look For

Geographic Location

Businesses headquartered in Northern Illinois, Southern Wisconsin, or run remotely

Consistency

Strong track record of stable earnings

Profitability

Annual Seller Discretionary Earnings of $500k to $2M

Not sure what this means? See our FAQs for detail.

Industry

Services or light manufacturing

The Process

Every process is different but a typical timeline can take 3 to 6 months

1) Starting the Relationship

Getting to know you and your business is at the core of what we do. We'll usually sign an NDA and start with an intro call or meeting.

2) Indication of Interest

After learning about your business and running the numbers with our lenders, we submit a brief summary of what a transaction could look like. Sometimes this can be as short as an email.

3) Letter of Intent

Once we've aligned on a deal, we'll write out the nitty-gritty details in a document called the Letter of Intent.

4) Diligence Period

We'll set a timeline (usually 60-90 days) and work with you to understand every detail of your business, inside and out. We'll also use this time to get our lender the right information to process the deal.

5) Deal Close

We sign the purchase agreement - time to hand over the keys!

6) Transition

For us a deal close is just a new beginning. We'll work with you to ensure a smooth transition, which supports your customers and employees every step of the way.

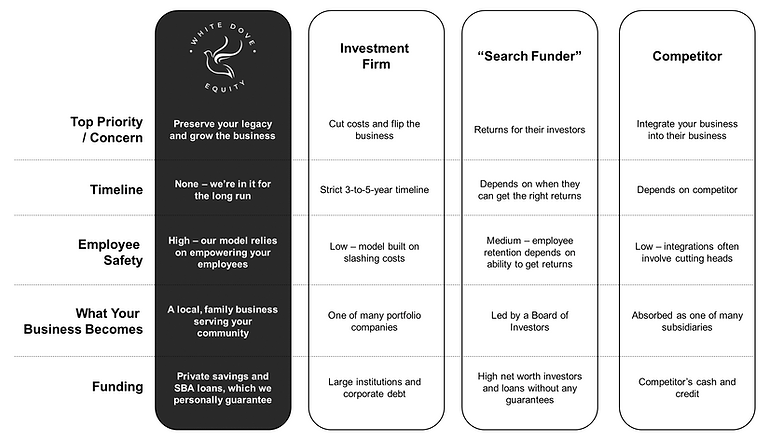

Why We're Different

Frequently Asked Questions

Why Are You Looking to Buy a Business?

After a decade of professional experience in top financial services firms and global corporations, it's time for a change. Applying my skills to managing and growing a small business is the perfect next step for my career and our family.

What is Your Source of Capital?

All of our equity comes from private personal savings. By taking this leap in buying a business, we are literally putting our money where our mouth is. For debt financing, we rely on the SBA 7(a) program and have been pre-approved with several of the top lenders.

Are My Employees Safe?

Yes! White Dove Equity was created to continue your legacy of serving your employees, customers, and community. Coming into a new business, we will be relying on your employees for a smooth transition. In many cases, some employees may even see an increase in their benefits and compensation.

What is Seller Discretionary Earnings?

Seller discretionary earnings (SDE) is a fancy word for looking at a small business' profitability. It is calculated by taking your taxable net income and adding (1) depreciation and amortization, (2) owner compensation, and (3) other owner expenses that will go away after an acquisition.

Our Partners

SBA Lender

SBA Lender

SBA Lender

Financial Support

Insurance Support

Legal Support

Get In Touch

If you're a business owner, broker, or just interested in learning more, please give us a call!

You can also send us an email or fill out the form.

We will treat any inquiry with the utmost confidentiality.

1512 Artaius Parkway

Suite 201

Libertyville, IL 60048

(312) 504-0686